Posted on Friday, 4th January 2019 by Dennis Damp

Many retirees and survivor annuitants call OPM to change direct deposit information and become frustrated because they can’t get through, their line is busy most of the time. OPM services 2,113,414 federal annuitants, 523,737 survivor annuitants plus postal service retirees as well.

It is easy to change monthly annuity payments from one financial institution to another if you understand your options. Direct Deposits will continue to be received by the originally selected financial institution until OPM and the U.S. Treasury are notified by the payee that the payee wishes to change the financial institution receiving the Direct Deposit.

It’s recommended that the annuitant maintain accounts at both financial institutions until the transition is complete. Don’t close your original account until after the new financial institution receives your first Direct Deposit payment.

If you are already receiving your federal benefit payment by direct deposit, and would like to have your payments sent to a different account use the procedures that follow to make the change. Recently, OPM and the U.S. Treasury made changes to the program including updating the link to the SF 1199A form.

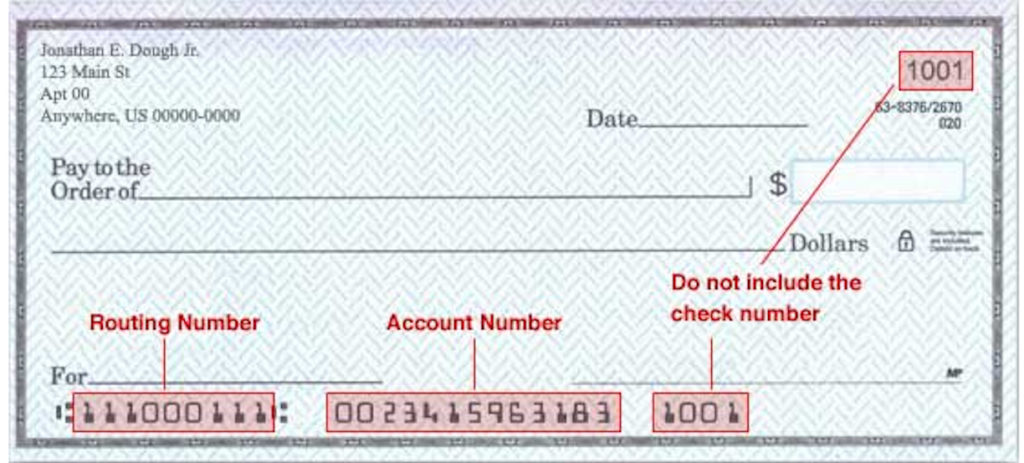

To enroll in Direct Deposit or to change your enrollment to a new account, OPM needs to know the routing number of the financial institution and your account number. The financial institution will provide this information or you can locate this information on the checks you use.

Use the following direct deposit change options:

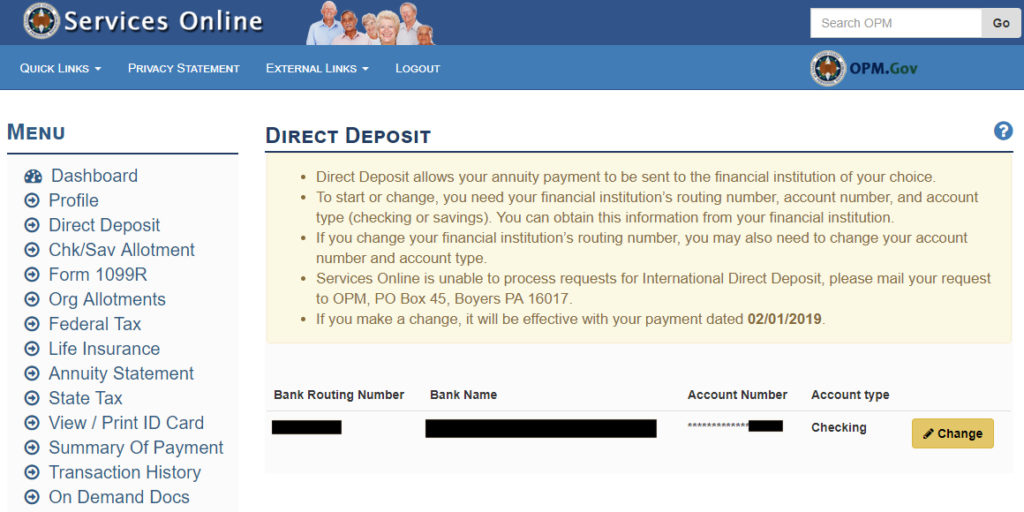

Using OPM’s Retirement Online Services makes changes like this easy, you can make this change online after registering for the free service. I signed into my account, see following graphic, and clicked on Direct Deposit. The blacked-out areas hide my personal account information. All you have to do is click on change and enter your new bank routing and account numbers. When you access the Direct Deposit page it will state what date your change will take effect in the last line above your personal data.

The menu to the left on the Services Online graphic show all that you can do once registered. You can obtain duplicate copies of your 1099 R statement, print out a statement outlining all of your life insurance coverage, initiate or change allotments, increase or decrease state tax withholding, print out a statement of your annuity that you can provide to lenders for loans, and much more. It is worth the time and effort to register for this service.

To register you must call OPM and they will send you access information in the mail. Yes, I know it’s difficult contacting them by phone. What I do is dial their number, if its busy I hang up and immediately click on redial, I typically get through in several minutes using this technique. Expect long wait times, I’ve waited on hold for up to 45 minutes.

Request a Federal Retirement Report™ today to review your projected annuity payments, income verses expenses, FEGLI, and TSP projections.

Helpful Retirement Planning Tools / Resources

Distribute these FREE tools to others that are planning their retirement

Disclaimer: Opinions expressed herein by the author are not an investment or benefit recommendation and are not meant to be relied upon in investment or benefit decisions. The author is not acting in an investment, tax, legal, benefit, or any other advisory capacity. This is not an investment or benefit research report. The author’s opinions expressed herein address only select aspects of various federal benefits and potential investment in securities of the TSP and companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that retirees, potential and existing investors conduct thorough investment and benefit research of their own, including detailed review of OPM guidance for benefit issues and for investments the companies’ SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice. The author explicitly disclaims any liability that may arise from the use of this material.